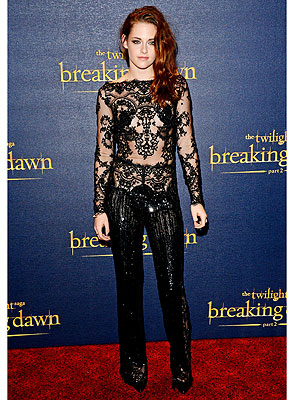

Tyler Hicks/The New York Times

A man injured by bombing in the Zaitoun neighborhood of Gaza City on Saturday that also killed one person. More Photos »

GAZA CITY — Israel broadened its assault on the Gaza Strip on Saturday from mostly military targets to centers of government infrastructure, obliterating the four-story headquarters of the Hamas prime minister with a barrage of five bombs.

The attack came a day after the prime minister, Ismail Haniyeh, hosted his Egyptian counterpart in that very building, a sign of Hamas’s new legitimacy in a radically redrawn Arab world. That stature was underscored Saturday by a visit to Gaza from the Tunisian foreign minister and the rapid convergence in Cairo of two Hamas allies, the prime minister of Turkey and the crown prince of Qatar, for talks with the Egyptian president and the chairman of Hamas on a possible cease-fire.

But the violent conflict showed no sign of abating as it finished its fourth day. Gaza militants again fired long-range missiles at the population center of Tel Aviv, among nearly 60 that soared into Israel on Saturday, injuring five civilians in an apartment building in Ashdod, in southern Israel, and four soldiers in an unidentified location.

Israel said it hit more than 200 targets overnight and continued with afternoon strikes on a Hamas commander’s home in the Gaza City neighborhood of Zeitoun and on a motorcycle-riding militant in the southern border town of Rafah. Israel has also made preparations for a possible ground invasion.

Hamas health officials said 45 Palestinians had been killed and 385 wounded since Wednesday’s escalation in the cross-border battle; 3 Israelis have died and 63 civilians have been injured.

“Everybody is afraid of what’s next,” said Mkhaimar Abusada, a political science professor at Al Azhar University in Cairo, predicting that the rockets fired at Tel Aviv and, on Friday, at Jerusalem, would provoke a rerun of Israel’s ground invasion four years ago.

Mr. Abusada and Efraim Halevy, a former head of Israel’s intelligence service, both said there is no clear endgame to the conflict, since Israel neither wants to re-engage in Gaza nor to eliminate Hamas and leave the territory to the chaos of more militant factions. “Ultimately,” Mr. Halevy said, “both sides want Hamas to remain in control, strange as it sounds.”

But Mr. Abusada cautioned that “there is no military solution to the Gaza problem,” saying: “There has to be a political settlement at the end of this. Without that, this conflict is just going to go on and on.”

In Cairo, a senior official of Egypt’s Muslim Brotherhood, the Islamist group allied with President Mohamed Morsi, said he was working furiously on Saturday to secure a cease-fire. Mr. Morsi met with the Turkish premiere, Recep Tayyip Erdogan, while Egypt’s foreign minister huddled with the Qatari prince and its intelligence chief sat with Khaled Meshaal, the chief of Hamas’s political wing, Egyptian media reported.

Hamas, which has controlled the Gaza Strip since 2007 but is considered a terrorist organization by Israel and the United States, wants to turn its Rafah crossing with Egypt into an open, free-trade zone, and for Israel to withdraw from the 1,000-foot buffer it patrols on Gaza’s northern and eastern borders. The Brotherhood official said that the Israeli side of the talks remained “the sticking point,” though he would not be specific about the issues.

Ben Rhodes, Mr. Obama’s deputy national security adviser, told reporters aboard Air Force One en route to Asia that the president had spoken daily with Prime Minister Benjamin Netanyahu of Israel since the crisis began, as well as to Mr. Erdogan and Mr. Morsi.

“They have the ability to play a constructive role in engaging Hamas and encouraging a process of de-escalation,” Mr. Rhodes said of the Turkish and Egyptian leaders. Describing rocket fire coming from Gaza as “the precipitating factor for the conflict,” he added, “We believe Israel has a right to defend itself and they’ll make their own decisions about the tactics that they use in that regard.”

But the Tunisian foreign minister, standing outside Al Shifa Hospital here, told reporters that Israel “has to respect the international law to stop the aggression against the Palestinian people.”

Mr. Netanyahu, for his part, spoke Saturday with the leaders of Germany, Italy, Greece and the Czech Republic, according to a statement from his office.